The Power of the Fed (2021)

Overview

When COVID-19 struck, the Federal Reserve stepped in to try to avert economic crisis. As the country's central bank continues to pump billions of dollars into the financial system daily, who is benefiting and at what cost?

Production Companies

Additional Info

| Budget | $0.00 |

|---|---|

| Revenue | $0.00 |

| Original Language | en |

| Popularity | 0.2952 |

Directed By

James Jacoby

TOP CAST

Similar Movies

The Bigger Bubble

After starting a painting business right before the housing crash, a filmmaker drives over 35,000 miles to track down the people who saw it coming and look ahead to the consequences of a decade of secret bank bailouts and 0% interest.

How to Win the Loser's Game

Sensible Investing's landmark documentary contains interviews with some of the biggest names and brightest minds in the investment world. The aim is to provide ordinary investors with the information they need - and to challenge the industry to offer consumers a fairer deal.

The Money Masters

A documentary that traces the origins of the political power structure that rules our nation and the world today. The modern political power structure has its roots in the hidden manipulation and accumulation of gold and other forms of money.

Let's Make Money

Let’s Make Money is an Austrian documentary by Erwin Wagenhofer released in the year 2008. It is about aspects of the development of the world wide financial system.

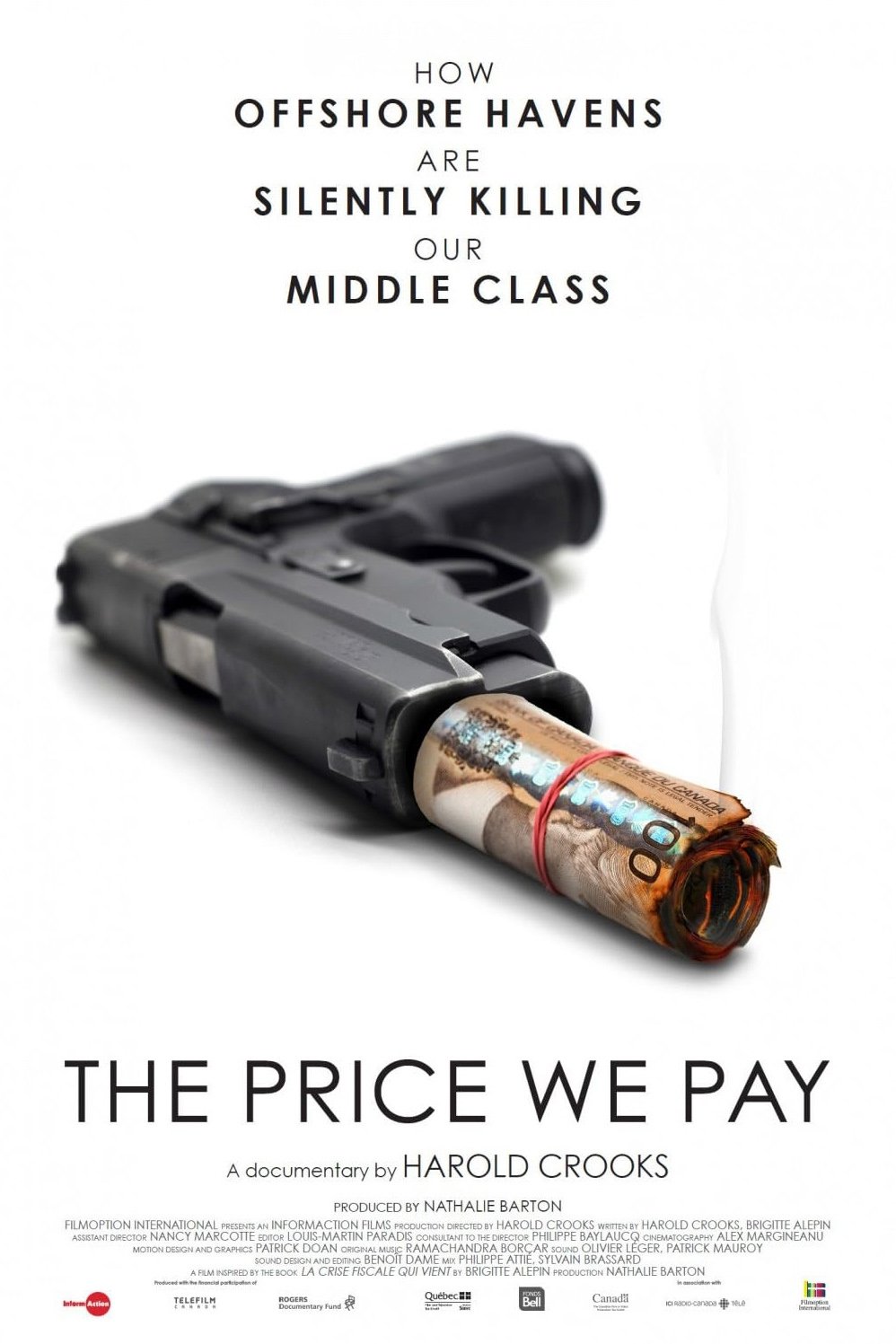

The Price We Pay

A documentary on the history and present-day reality of big-business tax avoidance, which has seen multinationals depriving governments of trillions of dollars in tax revenues by harboring profits in offshore havens.

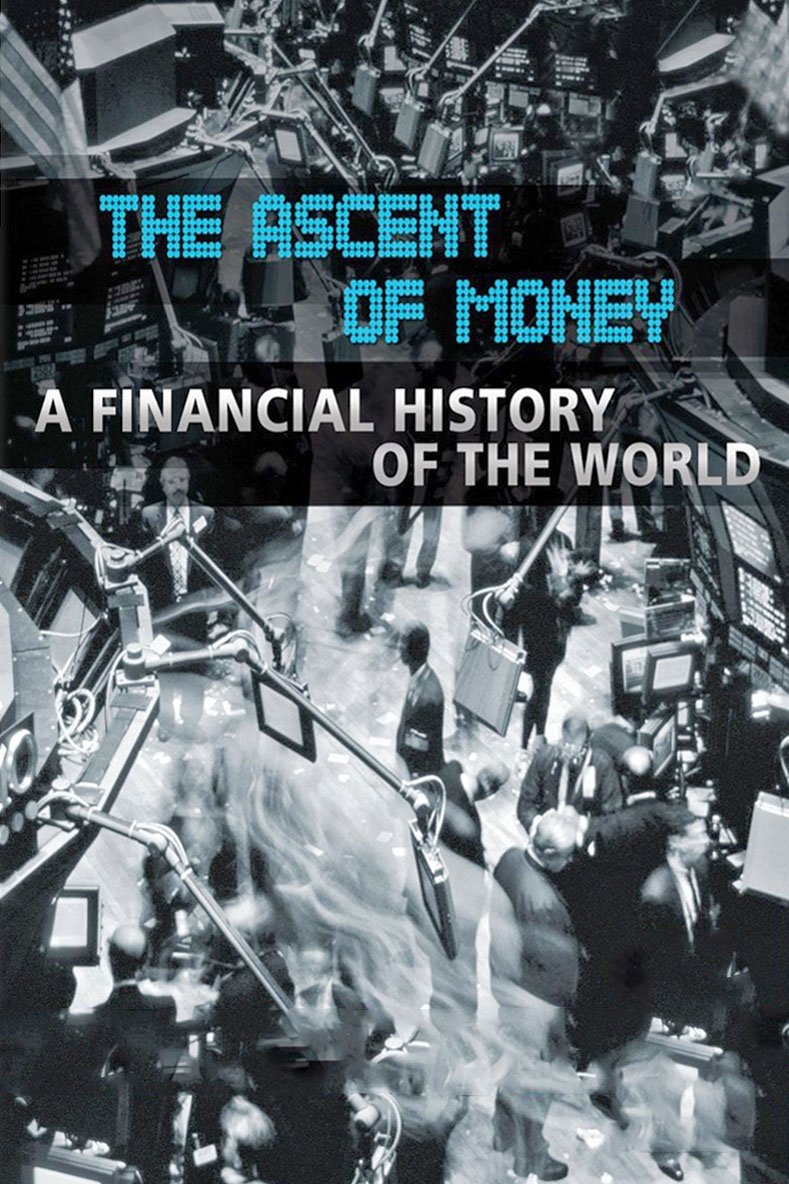

The Ascent of Money

British historian and author Niall Ferguson explains how big money works today as well as the causes of and solutions to economic catastrophes in this extended version The Ascent of Money documentary. Through interviews with top experts, such as former Federal Reserve Chairman Paul Volcker and American currency speculator George Soros, the intricate world of finance, including global commerce, banking and lending, is examined thoroughly.

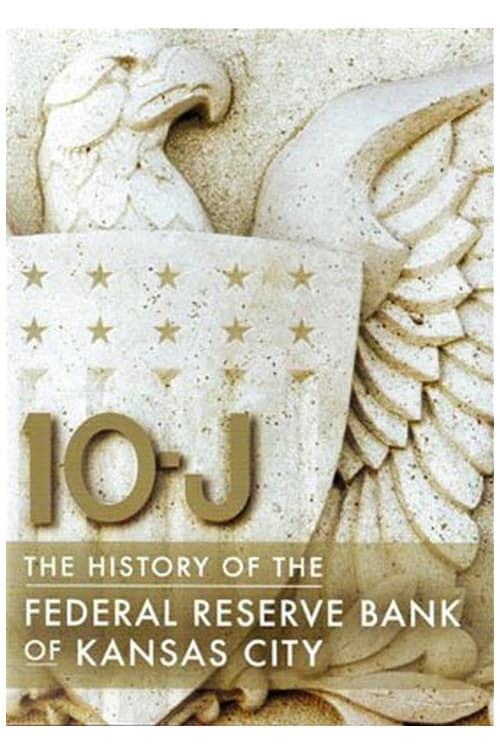

10-J: The History of the Federal Reserve Bank of Kansas City

In 1913 Congress created the Federal Reserve to bring financial stability to the nation after a number of banking panics, with a mix of regional banks and a central bank board. Congressmen Robert L. Owen and Carter Glass helped pass the Federal Reserve Act with the help of compromises led by President Woodrow Wilson. The Federal Reserve Bank of Kansas City was begun in 1914, led by Jo Zach Miller, Jr., along with local bankers such as William T. Kemper. With the bank rapidly growing, about 1920 a new 21 story building was built at 9th and Grand that at one time held the offices of the Bureau of Investigation and President Harry S. Truman.

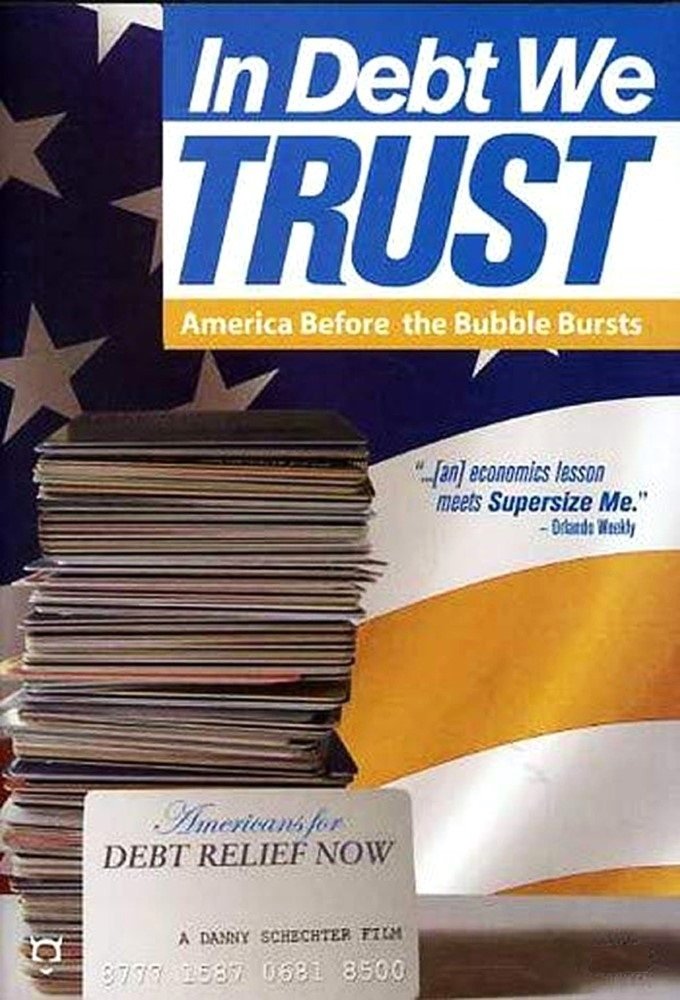

In Debt We Trust: America Before the Bubble Bursts

Emmy-winning journalist Danny Schechter investigates America's mounting debt crisis in this latest hard-hitting expose. The film reveals the unknown cabal of credit card companies, lobbyists, media conglomerates and the Bush administration itself who have colluded to deregulate the lending industry, ensuring that a culture of credit dependency can flourish. Schechter exposes the hidden financial and political complex that allows the lowest wage earners to indebt themselves so heavily that even house repossessions are commonplace.

Capitalism: A Love Story

Michael Moore comes home to the issue he's been examining throughout his career: the disastrous impact of corporate dominance on the everyday lives of Americans (and by default, the rest of the world).

The Bubble

Diving deep into the true causes of the Great Recession, the financial crisis of the 2010s, renowned economists, investors and business leaders explain what America is facing if we don't learn from our past mistakes. Is the economy really improving or are we just blowing up another Bubble?

Zeitgeist: Addendum

Zeitgeist: Addendum premiered at the 5th Annual Artivist Film Festival. Director Peter Joseph stated: "The failure of our world to resolve the issues of war, poverty, and corruption, rests within a gross ignorance about what guides human behavior to begin with. It address the true source of the instability in our society, while offering the only fundamental, long-term solution."

Inside Job

A film that exposes the shocking truth behind the economic crisis of 2008. The global financial meltdown, at a cost of over $20 trillion, resulted in millions of people losing their homes and jobs. Through extensive research and interviews with major financial insiders, politicians and journalists, Inside Job traces the rise of a rogue industry and unveils the corrosive relationships which have corrupted politics, regulation and academia.

Zembla - The Dubious Friends of Donald Trump Part 1: The Russians

For months, the FBI have been investigating Russian interference in the American presidential elections. ZEMBLA is investigating another explosive dossier concerning Trump’s involvement with the Russians: Trump’s business and personal ties to oligarchs from the former Soviet Union. Powerful billionaires suspected of money laundering and fraud, and of having contacts in Moscow and with the mafia. What do these relationships say about Trump and why does he deny them? How compromising are these dubious business relationships for the 45th president of the United States? And are there connections with the Netherlands? ZEMBLA meets with one of Trump’s controversial cronies and speaks with a former CIA agent, fraud investigators, attorneys, and an American senator among others.

Maxed Out

Maxed Out takes us on a journey deep inside the American debt-style, where everything seems okay as long as the minimum monthly payment arrives on time. Sure, most of us may have that sinking feeling that something isn't quite right, but we're told not to worry. After all, there's always more credit!

Laboratory Greece

A journey through Greece and Europe’s past and recent history: from the Second World War to the current crisis. It is a historical documentary, a look into many stories. «If Democracy can be destroyed in Greece, it can be destroyed throughout Europe» Paul Craig Roberts

Banking with Life

Banking With Life is a documentary that covers a lot of material in under an hour. Featuring financial experts and economists, as well as testimonies of actual clients, Banking With Life is the definitive primer on what the The Infinite Banking Concept™ is, and how anyone can use it to build wealth and experience financial freedom.

When Bubbles Burst

It is becoming increasingly difficult to protect ourselves from extreme financial volatility. This feature documentary will examine the mechanics behind bubbles and crashes, and discuss trends and visions for the future.

Four Horsemen

Documentary about the modern apocalypse caused by a rapacious banking system. 23 leading thinkers – frustrated at the failure of their respective disciplines – break their silence to explain how the world really works.